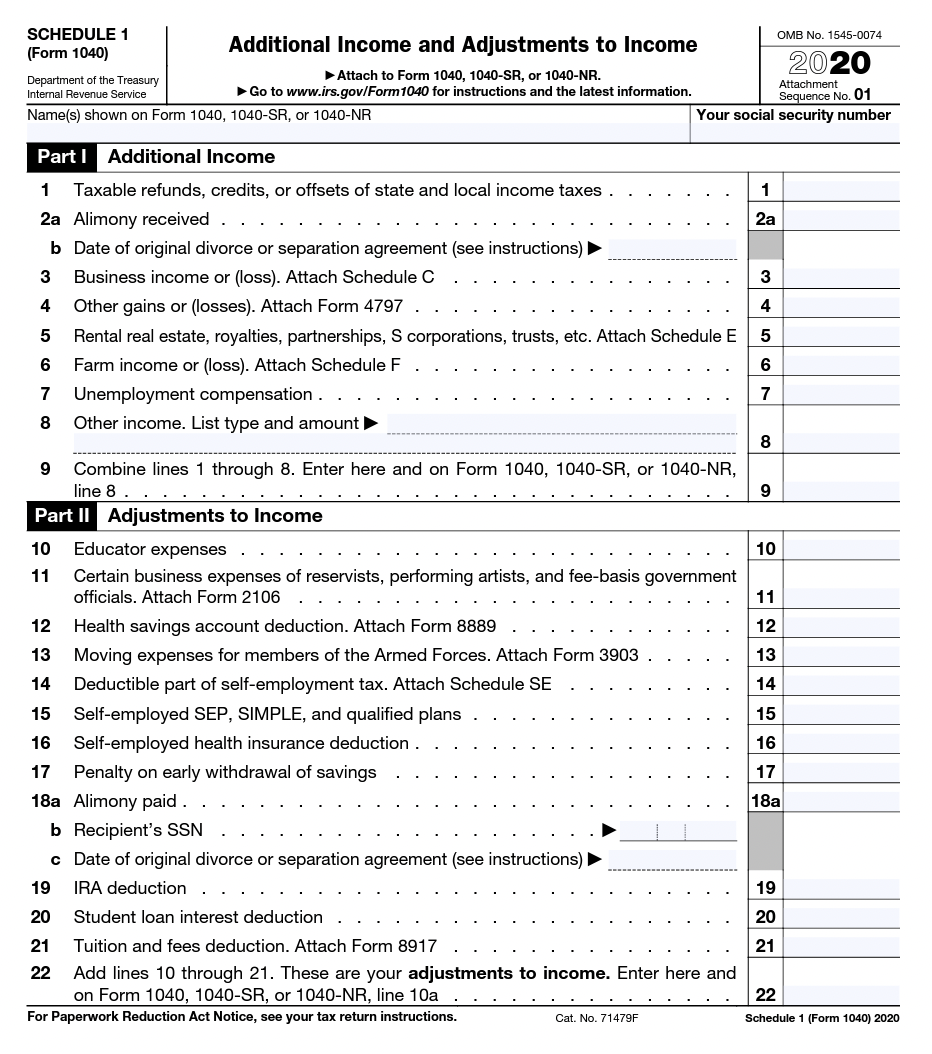

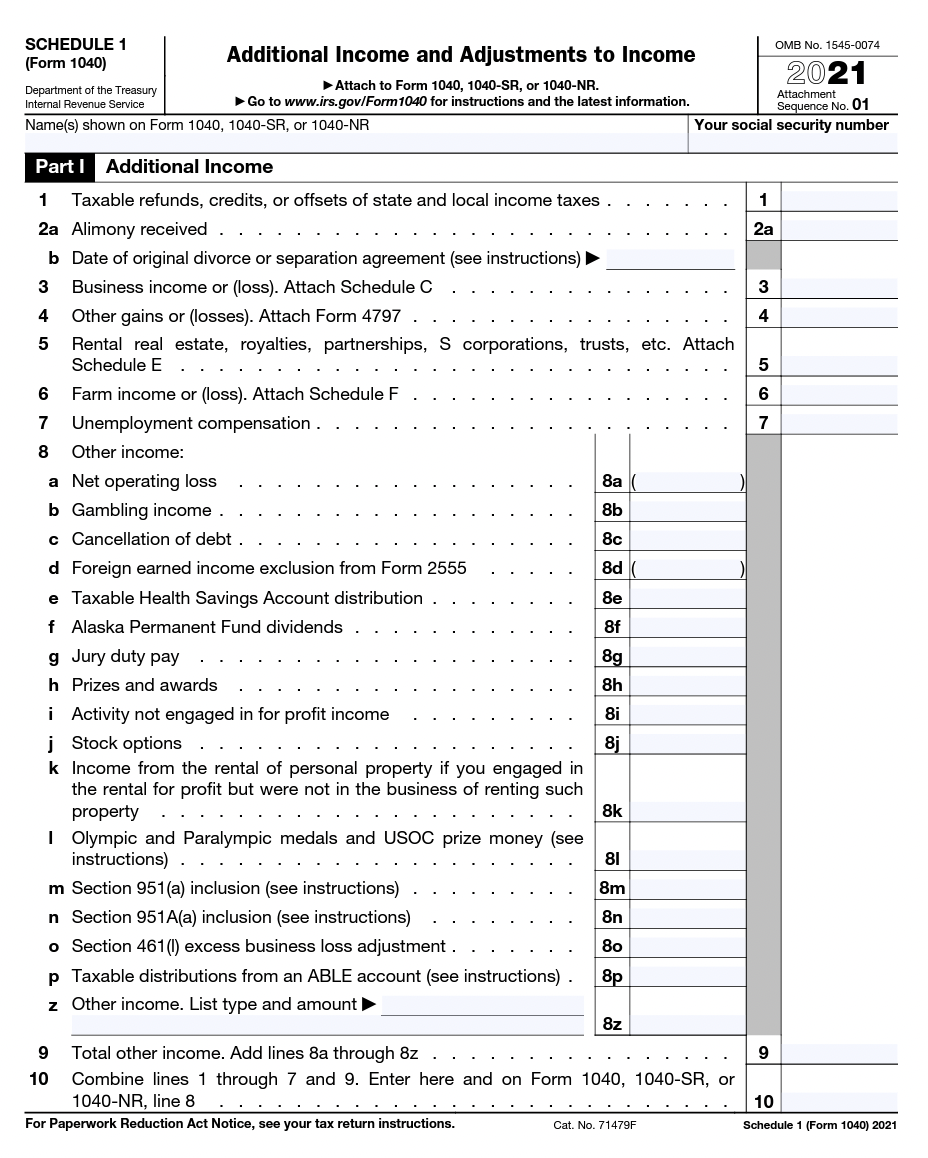

2024 Irs 1040 Schedule 1 – The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. . The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. .

2024 Irs 1040 Schedule 1

Source : tuition.asu.edu

IRS Form 2290 Filing Instructions, Due Date, & Mailing Address

Source : www.trucklogics.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

TruckDues.| Brentwood TN

Source : m.facebook.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

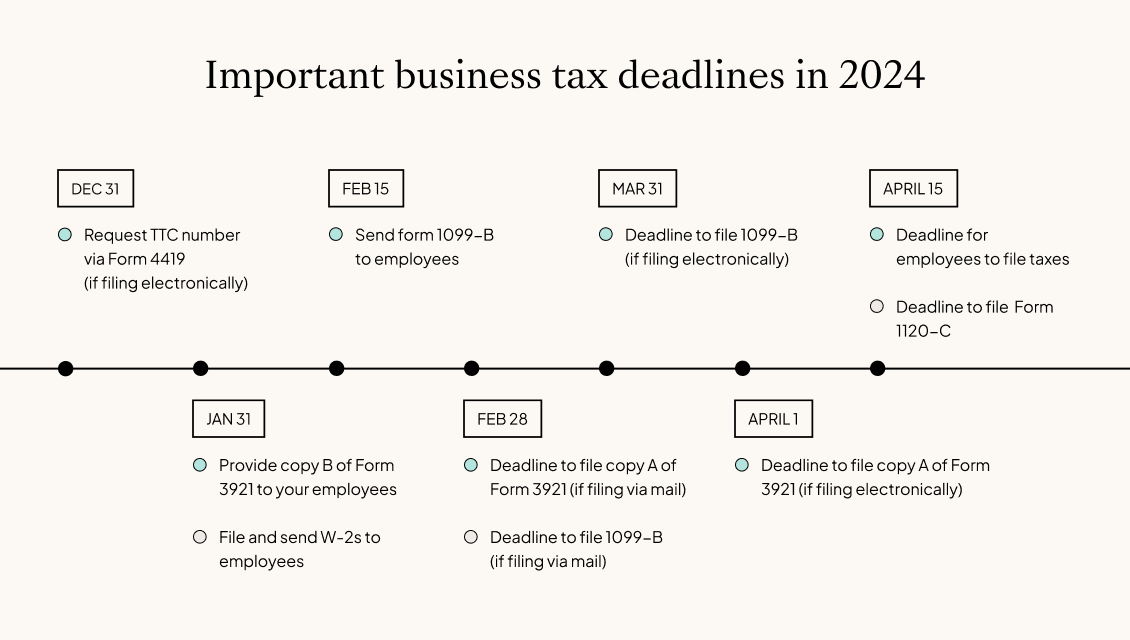

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

2023 2024 Verification Worksheet Dependent by Hofstra University

Source : issuu.com

2023 2024 Verification | TCTC

Source : www.tctc.edu

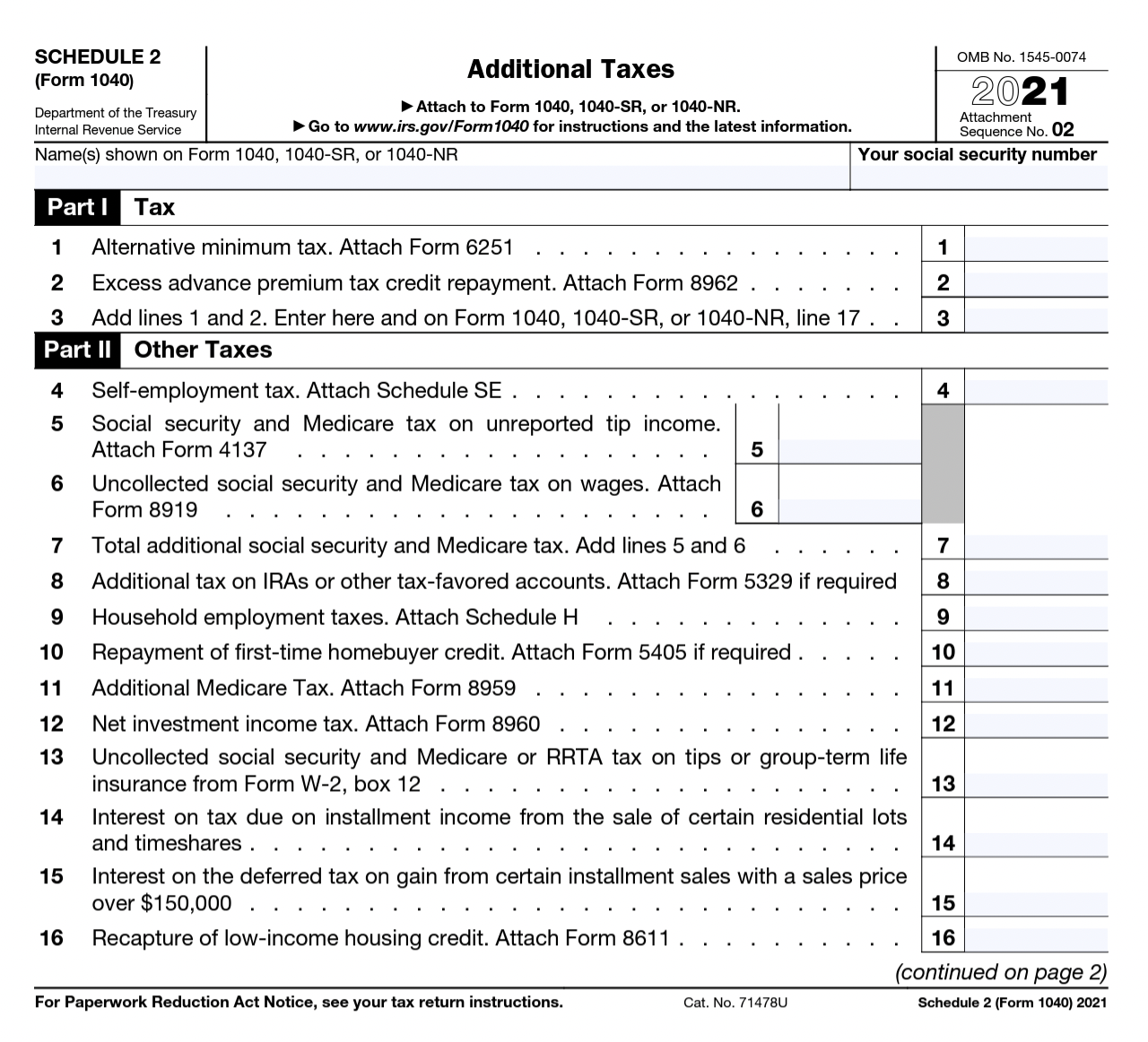

2024 Irs 1040 Schedule 1 Most commonly requested tax forms | Tuition | ASU: The changes to the 1040 are complicated, though, and take time, so delaying changes to tax year 2024 allows for additional feedback and an offsetting adjustment on a Form 1040, Schedule 1. That . Schedule A (Form 1040 or 1040-SR): Itemized Deductions is it is $20,800. For the tax year 2024, the standard deduction for single taxpayers and married couples filing separately is $14,600. .